The smart Trick of 501c3 Nonprofit That Nobody is Talking About

Wiki Article

8 Easy Facts About 501 C Shown

Table of ContentsThe Best Strategy To Use For Nonprofits Near MeMore About Non ProfitThe 9-Second Trick For Non Profit OrgThe Best Guide To 501c3 NonprofitNot known Incorrect Statements About Non Profit Org Some Of Not For Profit

While it is risk-free to say that many philanthropic companies are honorable, organizations can definitely struggle with a few of the exact same corruption that exists in the for-profit business globe - 501c3 nonprofit. The Blog post discovered that, between 2008 and also 2012, greater than 1,000 not-for-profit organizations examined a box on their internal revenue service Type 990, the tax obligation return type for exempt organizations, that they had experienced a "diversion" of possessions, meaning embezzlement or other scams.4 million from acquisitions linked to a sham company started by a previous assistant vice head of state at the organization. One more instance is Georgetown University, that experienced a substantial loss by a manager that paid himself $390,000 in extra compensation from a secret savings account previously unknown to the university. According to government auditors, these tales are all as well typical, and function as cautionary stories for those that seek to produce and also operate a charitable company.

In the situation of the HMOs, while their "promo of wellness for the benefit of the community" was deemed a philanthropic objective, the court determined they did not operate primarily to profit the community by offering wellness solutions "plus" something added to profit the area. Hence, the cancellation of their exempt standing was promoted.

501 C Fundamentals Explained

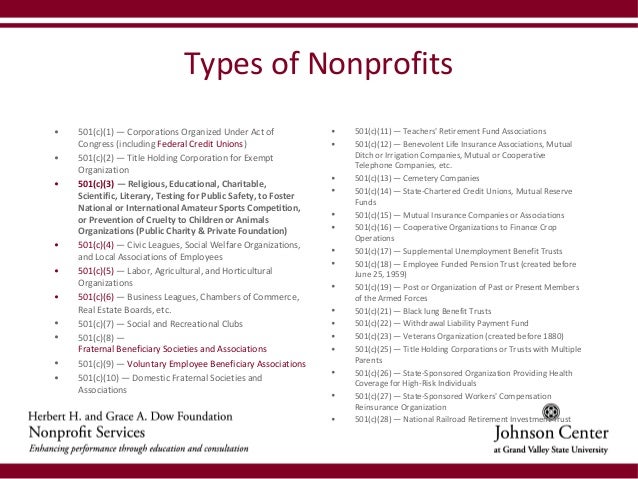

There was an "overriding government rate of interest" in restricting racial discrimination that outweighed the college's right to complimentary exercise of faith in this manner. 501(c)( 5) Organizations are organized labor as well as agricultural as well as gardening organizations. Labor unions are organizations that form when employees associate to participate in collective bargaining with an employer concerning to incomes and also advantages.By comparison, 501(c)( 10) organizations do not provide for payment of insurance benefits to its members, therefore might arrange with an insurance firm to offer optional insurance policy without jeopardizing its tax-exempt status.Credit unions and various other common economic organizations are categorized under 501(c)( 14) of the internal revenue service code, and also, as component of the banking sector, are heavily controlled.

A Biased View of Non Profit Organization Examples

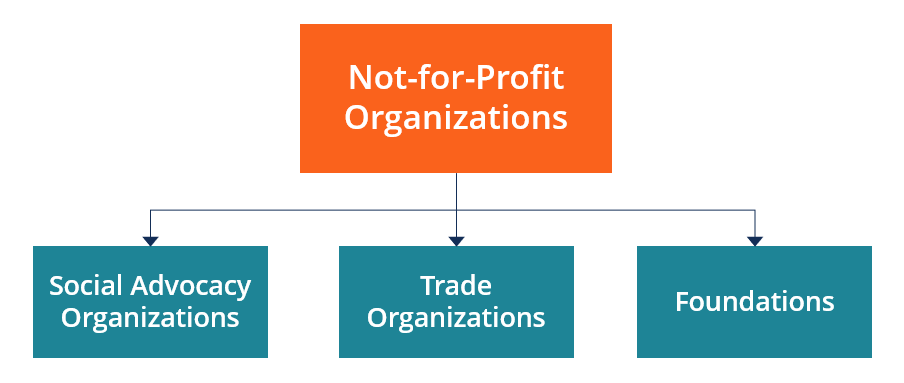

Getty Images/Halfpoint If you're taking into consideration starting a nonprofit organization, you'll desire to understand the various sorts of not-for-profit classifications. Each designation has their very own demands and compliances. Right here are the kinds of not-for-profit classifications to aid you make a decision which is ideal for your company. What is a nonprofit? A not-for-profit is a company running to advance a social reason or sustain a common goal.Provides settlement or insurance coverage to their participants upon illness or other distressing life events. Subscription needs to be within the exact same workplace or union.

g., online), even if the nonprofit does not straight get contributions from that state. Furthermore, the internal revenue service calls for disclosure of all states in which a nonprofit is registered on Form 990 if the nonprofit has income of greater than $25,000 each year. Fines for failure to sign up can include being forced to offer back donations or facing criminal costs.

About 501 C

com can assist you in signing up in those states in which you intend to obtain donations. A nonprofit company that obtains significant go to my blog parts of its income either from governmental sources or from straight contributions from the public may certify as a publicly sustained organization under section 509(a) of the Internal Earnings Code.

Due to the intricacy of the regulations and also guidelines governing designation as an openly supported company, incorporate. com advises that any kind of not-for-profit curious about this classification seek legal and also tax obligation advice to provide the essential guidance. Yes. Most people or teams create nonprofit firms in the state in which they will largely operate.

A not-for-profit company with organization places in multiple states may form in a solitary state, then sign up to do organization in various other states. This suggests that nonprofit firms must officially sign up, submit yearly records, and pay annual charges in every state in which they perform service. State laws require all nonprofit companies to maintain a signed up address with the Secretary of State in each state where they do service.

Not known Factual Statements About 501c3 Organization

Section 501(c)( 3) philanthropic companies may not intervene in political projects or perform substantial lobbying tasks. Consult an attorney for even more specific info concerning your company. Some states only require one supervisor, yet most of states need a minimum of three directors.

Not-for-profit firms, in contrast to their name, can make a important site profit but can't be developed mostly for profit-making., have you thought about organizing your endeavor as a not-for-profit company?

About 501 C

With a not-for-profit, any type of money that's left after the organization has paid its costs is put back right into the organization. Some types of nonprofits can receive contributions that are tax deductible to the individual who adds to the company.Report this wiki page